Sally Campbell, JBWere

Successful investing can be all about timing, and investment advisers aim to provide guidance around this every day – but it’s impossible to pick the perfect moment every time. The key to success can be in avoiding averages and observing markets data more closely.

Whilst we can rely on economic, fundamental and technical analysis to provide us with guidance, the future is uncertain and investment markets are volatile. The Australian equity market has declined close to 18% from its peak in late April of 5,955 (as measured by the S&P/ASX All Ordinaries Index) to its recent trough of 4,958 last week, before a slight bounce back in October. This excludes dividends paid over the period, but they would provide only a modest buffer against that decline.

AMP Capital recently undertook analysis of historical equity market falls, comparing market corrections with bear markets. Whilst there is no definitive definition of the two terms, AMP Capital took the view that a correction can be limited to sharp falls of ”up to 20%” which often last for only short periods of time and where equity markets trade back to new highs within six months or so. In contrast, bear markets experience losses in excess of 20%, last for extended periods of time and may take months or even years to reach new highs.

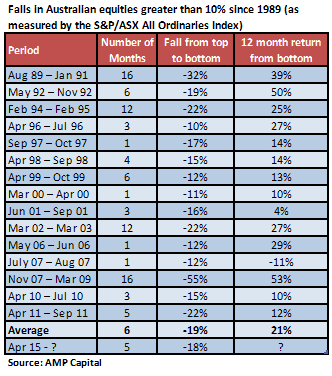

The analysis went on to highlight that the Australian equity market has fallen by 10% or more 15 times since 1989 – a decline in equity markets of 10% every two years over the last 25 years or so. Whilst this current market decline feels significant, it corresponds with 15 other occasions over recent years and looking at the numbers, the current market decline is surprisingly unremarkable at this stage. The period is currently five months compared with the six-month average duration and the markets have fallen 18% so far, slightly below the 19% average decline.

Importantly 14 of the 15 prior periods subsequently saw equity markets generate a positive return over the following 12 months (July 2007 was the exception with a unique single month decline, a possible precursor to the global financial crisis which began three months later).

As always, using averages can hide the complexity in investment markets. From the table below, you can see the average 12-month return following these corrections is 21% but the starting point is key. Were equity markets cheap or expensive before the market correction? The answer will have a significant impact on the size and sustainability of any rebound.

This analysis highlights that corrections do happen, very frequently in fact, however history has shown us that selling out after the market decline has already occurred simply ensures you lock in the losses.

Identifying the absolute bottom of the market every time is almost impossible. What we can do is focus on fundamental analysis. Yes, Australian equity markets have declined close to 18% with a slight recent rebound. This has had a significant impact on our portfolios. But the next question is, do we believe this market decline, or more specifically the reason for the market decline, will have an impact on the earnings of the businesses in which we invest. If the answer is yes, then you do need to consider rebalancing your portfolio? If the answer is no, then it is likely that the market decline has made the valuations even more attractive and may justify further investments for those with excess cash.

Investor portfolios have all been impacted by recent market declines, however we don’t believe investors should be realising these losses and moving to the sidelines. As the table below highlights, in almost all cases following market declines, equities have generated attracted returns over the following 12 month period. Realising losses now, may mean missing out on that eventual rebound.